A Path Back to Confidence, Utility & Sustainable Growth

Star Atlas has never lacked ambition. A fully on-chain economy, a dual-token structure, deep production chains, and a player-driven market were always meant to form the backbone of a living interstellar economy. Yet over the past two years, the economic layer has weakened—ATLAS has depreciated, liquidity has thinned, and many of the reinvestment loops that once powered the ecosystem have become economically uncompetitive.

Today, we’re publishing our analytical whitepaper, Reviving the Star Atlas Economy, authored by Viktor, one of Aephia’s managers and lead data runner. In it, he takes a hard look at what went wrong and lays out a comprehensive policy framework to restore the ATLAS economy’s health. Below, we break down the paper’s core insights and proposed path forward.

The Core Problem: A Breakdown in Monetary Credibility

ATLAS is the lifeblood of Star Atlas. It’s the unit of account, the medium of exchange, and the reward token across nearly every gameplay system. Its strength—or weakness—directly affects participation.

Over the past year, the correlation between ATLAS/SOL and daily active users has been consistently ~0.96, an extraordinarily high relationship. When ATLAS strengthens in relation to SOL, engagement tends to rise. When it weakens, players retreat.

In short, economic sentiment in Star Atlas is tightly anchored to the relative purchasing power of ATLAS.

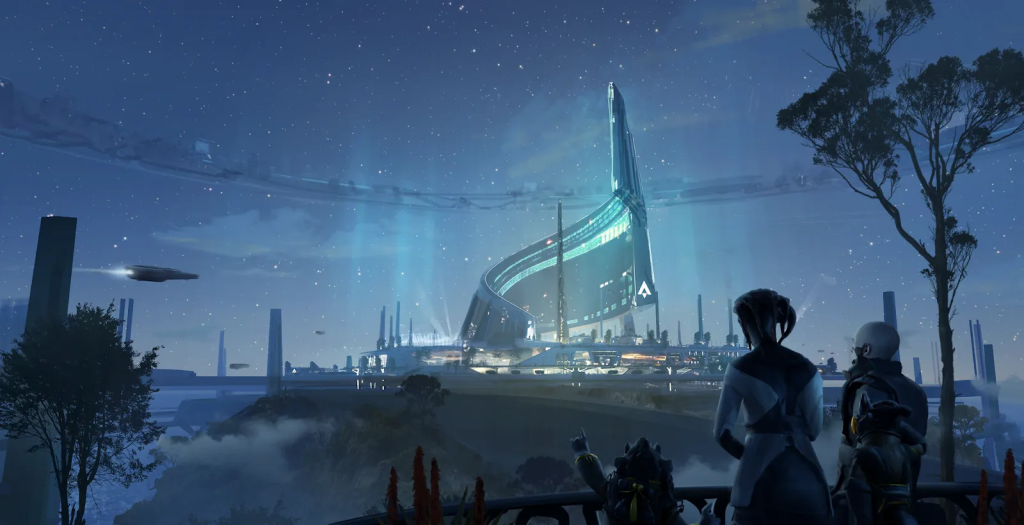

Star Atlas – The center of the ONI CSS – One of the three economic hubs in-game

Three structural failures have eroded that purchasing power:

1. The Disappearance of Competitive ATLAS Sinks

Players can still craft components, craft Faction Infrastructure Contracts, and upgrade starbases. These loops remain intact, but they all result in the creation of ATLAS rather than reducing its emissions.

By contrast, ship redemption recipes were the only mechanic that converted raw materials and components into game assets instead of newly emitted ATLAS.

Without redemption functioning properly, one of the largest and most meaningful reinvestment pathways was lost. Players had fewer economically viable ways to convert their production into long-term assets, weakening the internal liquidity cycle.

Economic sentiment in Star Atlas is tightly anchored to the relative purchasing power of ATLAS

2. Primary-Market Prices That Don’t Reflect Reality

ATMTA continues to list ships and assets at origination-anchored prices far above what players are willing to pay. This disconnect between primary and secondary markets means:

- Primary-market purchases stall

- Players have no reason to spend ATLAS or USDC on new assets

- Marketplace turnover shrinks

- One of the major ATLAS sinks disappears

The result: price discovery breaks, and reinvestment incentives fade.

3. Continuous Token Liquidation

Although ATMTA’s ongoing hourly ATLAS & POLIS sales are small in size, they create a persistent negative signal:

“the team is constantly selling ATLAS to generate cashflow.”

This signaling effect matters. It shapes expectations and reinforces the perception that ATLAS will continue to depreciate, which in turn dampens participation.

These three dynamics reinforce one another, creating a cautious, low-liquidity economic environment that struggles to support long-term engagement.

Why Gameplay Improvements Alone Aren’t Enough

Star Atlas cannot build a thriving metaverse on top of a currency whose value is unstable or lacks credibility.

Even strong gameplay updates cannot compensate for weakening monetary foundations. The economy must be stabilized before growth can take hold.

Our paper proposes a four-pillar policy strategy to rebuild the ATLAS economy. Together, these pillars address the structural misalignments identified earlier.

1. Restore Ship Redemption & Reinvestment Pathways

The highest-impact reform is the reintroduction of ship redemption recipes and broader reinvestment channels—at prices aligned with actual market conditions.

Historically, redemption allowed players to turn raw materials and components into game assets rather than routing them into ATLAS-generating loops that amplify emissions. When redemption disappeared (or became non-competitive), crafting loops funneled raw materials into FICs, which ATMTA buys with ATLAS, increasing emissions.

Bringing it back—across a wide range of ship classes and roles—would:

- Restore ATLAS utility

- Reduce pressure from emissions

- Re-enable long-term portfolio building

- Encourage productive reinvestment over extraction

A healthy economy begins with attractive ways to reinvest.

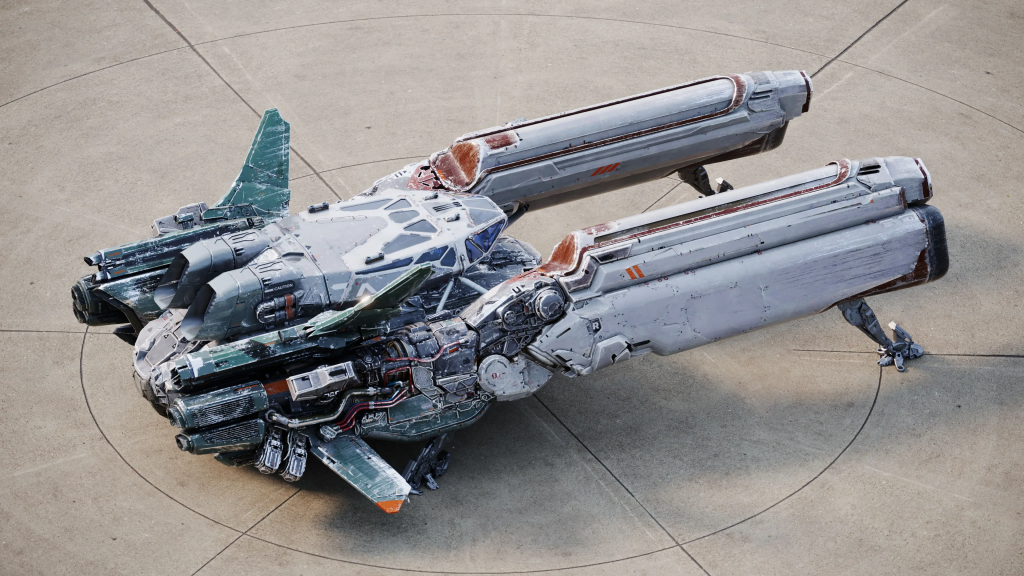

Star Atlas – Fimbul Mamba EX – One of the first “craftable” (redeemable) ships in SAGE

2. Align Primary-Market Prices With Secondary Markets

The primary market must reflect actual player demand.

Star Atlas’ primary market currently operates as if it’s frozen in time. Origination anchors—set years ago—were meant to protect early buyers, but now prevent the emergence of any coherent market equilibrium. With ATLAS down massively in real terms, these prices are no longer meaningful. Aligning both USDC and ATLAS tranches with secondary-market pricing would:

- Revive primary-market sales

- Reactivate ATLAS spending

- Boost marketplace turnover

- Increase ATMTA’s revenue from both fees and asset sales

Critically, it would also help re-establish ATLAS as a viable unit of account.

3. Move Away From Continuous Token Sales

Token liquidation depresses expectations and becomes less effective as ATLAS’s value declines. We recommend transitioning toward endogenous revenue—meaning revenue generated by a healthy economy rather than by selling tokens.

This includes:

- Competitively priced asset sales

- Higher secondary-market turnover

- Natural reinvestment loops

- Fee-based revenue as the economy grows

This model aligns player and developer incentives in a way token sales never can.

4. Increase Transparency & Predictability

Finally, trust requires clarity. We recommend that ATMTA provide regular insights into:

- Token supply actions

- ATLAS sink performance

- Pricing methodologies

- Economic policy adjustments

Predictable policy encourages long-term planning and reduces hesitation across the player base.

Expected Outcomes

If implemented as a unified framework—not as isolated patches—we anticipate a flywheel effect:

- Competitive ATLAS sinks return → production converts into assets instead of emissions

- Primary prices realign → ATLAS and USDC become spendable again

- Endogenous revenue grows → token sales decline

- Transparency improves → expectations stabilize, engagement rises

This is how the economic flywheel restarts.

Final Thoughts

The Star Atlas economy is not suffering from a temporary downturn. It is suffering from structural misalignments. But the good news—emphasized clearly throughout our whitepaper—is that these issues are solvable, and solving them does not require new technology or new game modes. It requires coherent economic governance.

Star Atlas has the infrastructure, the assets, the community, and the long-term vision. What’s needed now is a monetary and market framework that restores credibility, supports reinvestment, and aligns incentives.

If ATMTA adopts the framework outlined in our whitepaper, Star Atlas can evolve into a robust, self-reinforcing, player-driven economy—one that finally unlocks the incredible potential its design has promised since day one.

Check out our full Whitepaper here: Reviving the Star Atlas Economy: A Framework for Restoring Confidence and Circulation in ATLAS.